The People In Your Corner®

We're here for you.

At CCU, we offer better earning, spending and saving options.

Our branches are state-of-the-art spaces with our ITMs typically available inside and drive-thru.

Investing in our people is the best way to help them help you as a member.

If you’re looking for people who act in your best interest when it comes to managing your money, you’ve landed in the right place.

We want to hear from you.

We go to work to help our members, not profit off them. We never forget how hard you’ve worked for your money, and we make it work as hard as it possibly can for you. It's a business about people, not money—though we take the utmost care of yours.

Being member-focused is more than just a mission statement—it is the foundation of our credit union.

- Call us at 877.275.2228

- Provide your feedback in this short survey.

- Connect with us on Facebook, Instagram, LinkedIn and YouTube. Like, follow, subscribe and comment. Or, just take a few seconds to enjoy our recent commercials!

- Learn more about our community involvement and join us at our next event.

- Read the latest message from our CEO.

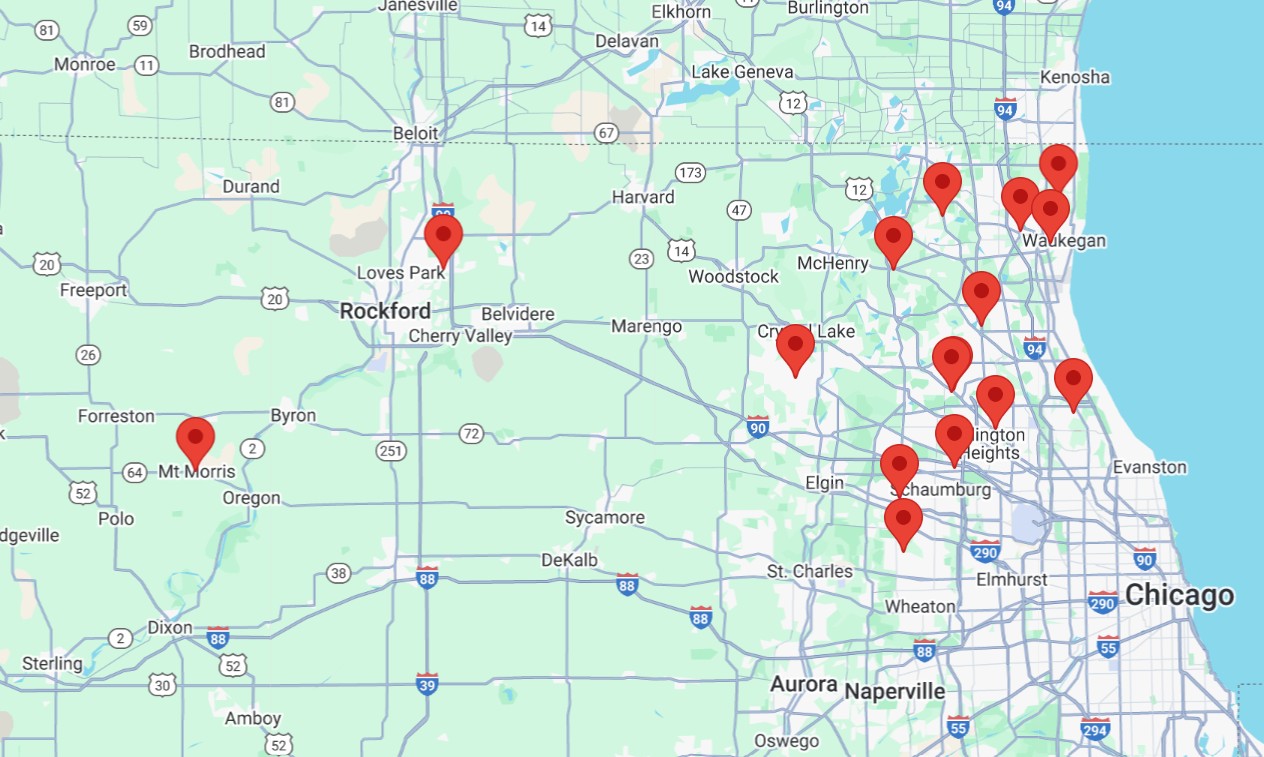

Branches around your corner

Growing now and going forward. CCU is one of the largest credit unions in Illinois, with $4.3 billion in assets and serving more than 274,000 members. We're owned and operated by our members, who elect our all-volunteer Board of Directors.

Find a Branch

*APY = Annual Percentage Yield. CCU’s free Rewards Checking account is a tiered rate account based on qualifying activity. For balances from $ .01 - $10,000, the rate is based on qualifying activity and can range from 3.00% - 5.00% APY if minimum qualifications are met. For all tiers, if minimum qualifications are met, balances from $10,000.01 - $25,000.00 earn 0.20% APY and balances $25,000.01 and greater earn 0.10% APY. Please see all terms and conditions on qualifying rate tiers. Fees may reduce earnings. No minimum balance required. Minimum $5.00 opening deposit required.