Visa Cards

Whether you're looking for lower rates or better rewards,

we have a card that's right for you.

0% APR* Intro Rate+

0% APR** Intro Balance Transfers

You can also enjoy an introductory rate of 0% APR on Balance Transfers for 12 months from account opening. After that, your APR will be 13.20% to 27.49% based on your creditworthiness. This APR will vary with the market based on the Prime Rate.

$200 Reward^

+Offer extended to December 31, 2026. This promotion is available for a limited time. New qualifying card members will receive a special introductory rate of 0% APR on purchases for 12 months from account opening. After the 12-month period, the interest rate will revert to the standard card rate.

*APR = Annual Percentage Rate. Fees may be imposed on the account. Rates are variable, based on the published Prime Rate. For new cards, rates will vary based on creditworthiness.

^ To qualify for the $200 reward, the cardmember must make $1,000 in net new purchases within the first 90 days of account opening. Depending on the card type, eligible rewards will be credited to the account within 2 statement periods as either 20,000 in points or a statement credit. Note: Current card members are not eligible for this offer. Closing and reapplying for the same card during the promotional period is prohibited.

**APR = Annual Percentage Rate. To qualify for the introductory 0% APR balance transfer rate for 12 months, transferred balances must be made within 45 days of account opening. A balance transfer fee of the greater of 3% of the transferred balance or $10 applies to each transferred balance.

View all Visa Agreements and Disclosures.

NEW! Visa Signature Your Cash Back

- Earn unlimited 1.5% cash back on all your everyday purchases

- Built with simplicity in mind and no reward categories to manage

- Visa Signature benefits provide security, identity, travel and purchase protections, and more

- Earn bonus cash back when shopping at exclusive merchants through our Cash Back Mall

- No Annual Fee

Visa Signature Flex Rewards

- Earn unlimited 3x points on everyday expenses such as Groceries, Restaurants & Fast Food, and even Food Delivery Services, 2x points on Gas/EV Charging*, unlimited 2x points on Local Transportation and Streaming Services, plus unlimited 1x points on all other purchases

- Visa Signature benefits include concierge services, bonus shopping offers, travel protections, and exclusive event & experience access

- No Annual Fee

*Earn 2X points on the first $6,000 in annual Gas/EV purchases, then unlimited 1X points for the remainder of the year. Then, 2X points will reset and can be earned for the following year.

Visa Platinum Active Rewards

- A card that works just as hard as you do with unlimited 2x points on everyday Local Commuting, Live Entertainment & Streaming Services, Fitness & Leisure, and even Cell Phone Services, plus unlimited 1x points on all other purchases

- Visa Platinum benefits provide purchase and extended warranty protection, cell phone protection, travel & emergency assistance services, and more

- No Annual Fee

Visa Platinum

- Our lowest rate card, perfect for those new to credit, building credit, or seek the simplicity of a traditional credit card

- The Visa Platinum card provides purchase and extended warranty protection, roadside dispatch, fraud and credit bureau monitoring, and is mobile/digital wallet capable

- No Annual Fee

Student Visa

- Help your student build credit and manage expenses responsibly

- Available for Students Ages 13-21*

- Credit Limits Starting as Low as $250

* A qualified primary applicant is required, the Student will be an authorized user.

Start them on the road toward financial responsibility but maintain your peace of mind with a CCU Student Visa credit card. This card starts building good credit scores while teaching students to budget their finances and manage a line of credit.

Helpful Phone Numbers (PIN updates, Lost or Stolen Cards, Card Services)

Activate and Update PIN For Debit Cards: 866.985.2273

Credit Card Pin Update: 888.886.0083

24/7 Cardholder Service Debit Cards: 888.908.7833

24/7 Cardholder Service Credit Cards: 866.820.3842

24/7 Fraud Monitoring Service: 888.918.7313

Report a Lost or Stolen Card for Debit Cards: 888.908.7833

Report a Lost or Stolen Card for Credit Cards: 866.820.3842

Replacement Card and Card Management

Card Services within Digital Banking allows you to enable or disable your card, report it as lost or stolen, and more.

Lock / Unlock Card

Easily and securely enable/disable your card within digital banking.

CardSwap

Updating your payment information just got easier. CardSwap is a single spot to update your card on file wherever you pay – subscription and streaming services, eCommerce merchants, and more.

Visa Alerts

- Receive a text message or e-mail when your card is used.

- Set custom alerts for transaction types and dollar amounts for:

- Approaching credit line

- Purchases over a selected amount

- Purchases outside of selected states

- International purchases

- Online and phone purchase where the card is not physically present

- Declined transaction

Add or Remove an Authorized User

Protected Credit Transactions

Add or Remove a Joint Owner

Request a Credit Limit Increase

Tap to pay – your way

Check out in seconds with CCU Contactless Visa cards. A quick, convenient, and secure way to pay.

Forgot your credit card? No problem! Simply add your credit card to your digital wallet (such as Apple Pay, Google Pay, Samsung Pay, etc.) and you're set to tap and pay with your mobile device. Learn more about how to add your CCU Card to your Mobile Wallet with this video.

New! Tap to Add

Getting started is easier than ever. With Visa’s new Tap to Add feature, you can add your CCU Contactless Visa card to your Apple Pay digital wallet instantly. Just tap your physical card on the back of your phone to enroll. No manual entry needed.

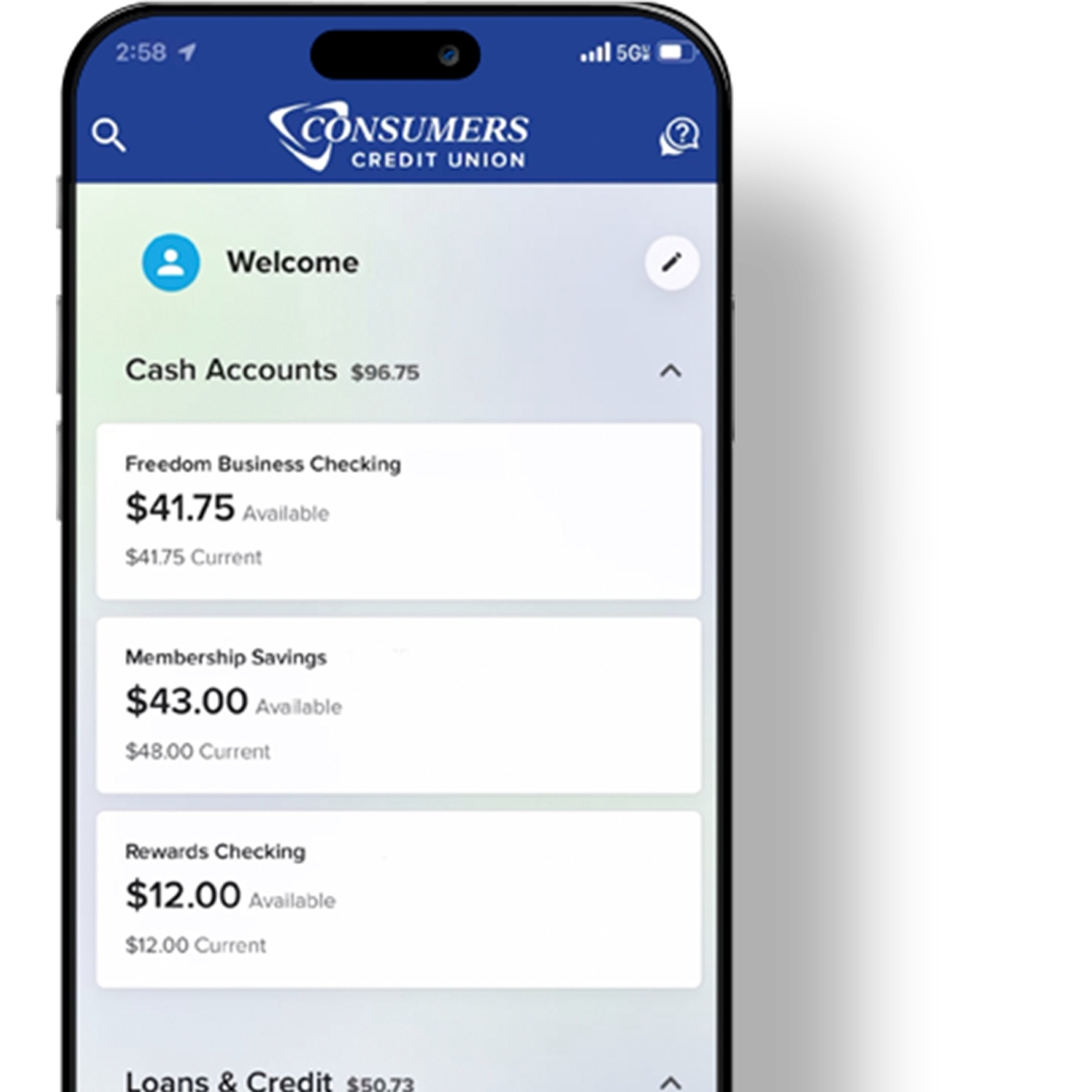

CCU Rewards Checking + Visa Cards

Combine your CCU Rewards checking with one of our Visa cards and be on your way to earning up to 5.00% APY on your rewards checking balances.

Smart Saver

Deposit a minimum of $50 or up to $1,000 each month to earn a higher dividend when paired with a CCU Checking Account.

Learn about Business Visa Cards here.

Store Credit Cards: Are They A Good Deal?

Store credit cards can be easy to sign up for (application is stressed at checkout), but they may not be the great deal they seem.

Get Smart About Credit Warning Signs

Credit card debt is very widespread. Here are several warning signs that indicate you’ll need to change your spending habits.

The Common Risks of Identity Theft - Part 2

In part 1, we brought you part of an article detailing identity theft risks. Part 2 gets even more in-depth, helping you to avoid being a victim.