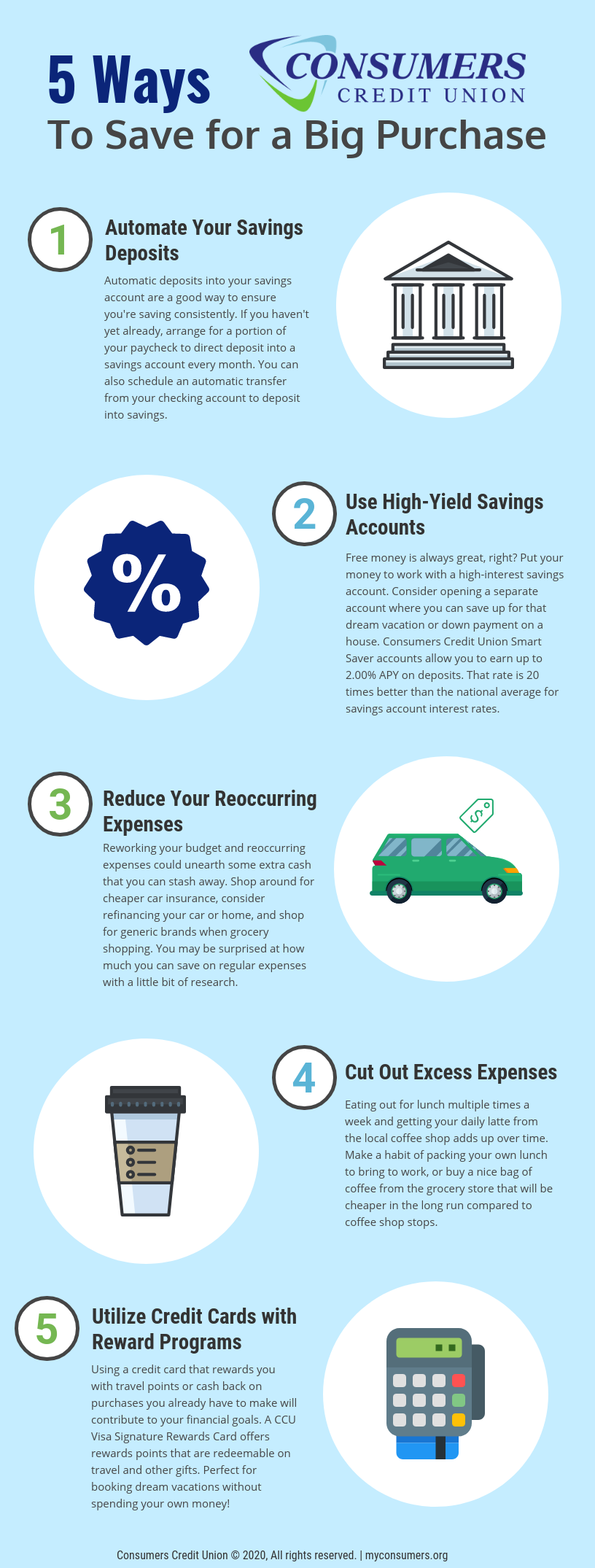

5 Things You Can Do Today to Start Saving for a Big Purchase

We all have financial goals that are important for a variety of reasons. Maybe you are saving up for a down payment for a new house, or you're looking to take that dream European vacation. No matter what your aspiration is, it will take time up the cash for your big purchase.

In this blog, we'll go over some things you can start doing today to make your financial dreams come true.

Automate Deposits into Savings

Consider automating deposits into the account you are saving up for your big purchase in. You can do this in a couple different ways.

If you haven't already, arrange for a part of your paycheck to be direct deposited into your savings account. You can also schedule an automatic transfer from your checking account to deposit into savings.

Having an automatic savings deposit set up is an easy way to force yourself into making sure you put a consistent dollar amount into savings.

Take Advantage of of High-Yield Savings Accounts

Who doesn't like free money? A high-yield savings account will grow your money for you, allowing you to save money faster.

Consumers Credit Union's Smart Saver account lets you stash away up to $1,000 each month with a 2.00% APY. That rate is 20x better than the national average for savings rates.

Rework Your Reoccurring Expenses/Budget

There are some expenses that aren't going away like car insurance or groceries, but there are things you can do to trim your budget.

Check with your car insurance provider to see if there is a cheaper premium that you can pay, or shop around for new car insurance. You can also consider refinancing your car or home with a lower interest rate.

When grocery shopping, see what generic brands you can buy instead of name brands, and be on the lookout for sales on produce and meat. You can cook a great meal with store-brand ingredients and proteins that are only on sale because they weren't sold from behind the meat counter the previous day.

Look to Cut Excess Expenses

They may seem inconsequential because of the relatively low cost, but that daily coffee or weekly lunch out start to add up.

Making coffee at home and packing your lunch for work will save you money each week. If you can't completely cut yourself off from that coffeehouse drink, budget a certain amount of spending money for yourself each month so you can still enjoy the little things in life.

If there is a necessary purchase that comes up in your life, do some comparison shopping. You may find the same item cheaper at a different store.

Utilize Credit Card Rewards

We're not saying it is a good idea to rack up debt on a credit card (in fact, that's a bad idea!).

However, there are many different types of credit cards that can help you towards financial goals just by making purchases you would have made anyway. A Visa Signature Rewards Card from Consumers Credit Union offers reward points that are redeemable on travel and other gifts. You may be able to pay for parts of your dream vacation through purchases you would have made anyway!

When saving for a big purchase, it may seem like you'll never reach your goal. However, just by making some small adjustments to your budgeting, you can reach that purchase in no time.

;

;