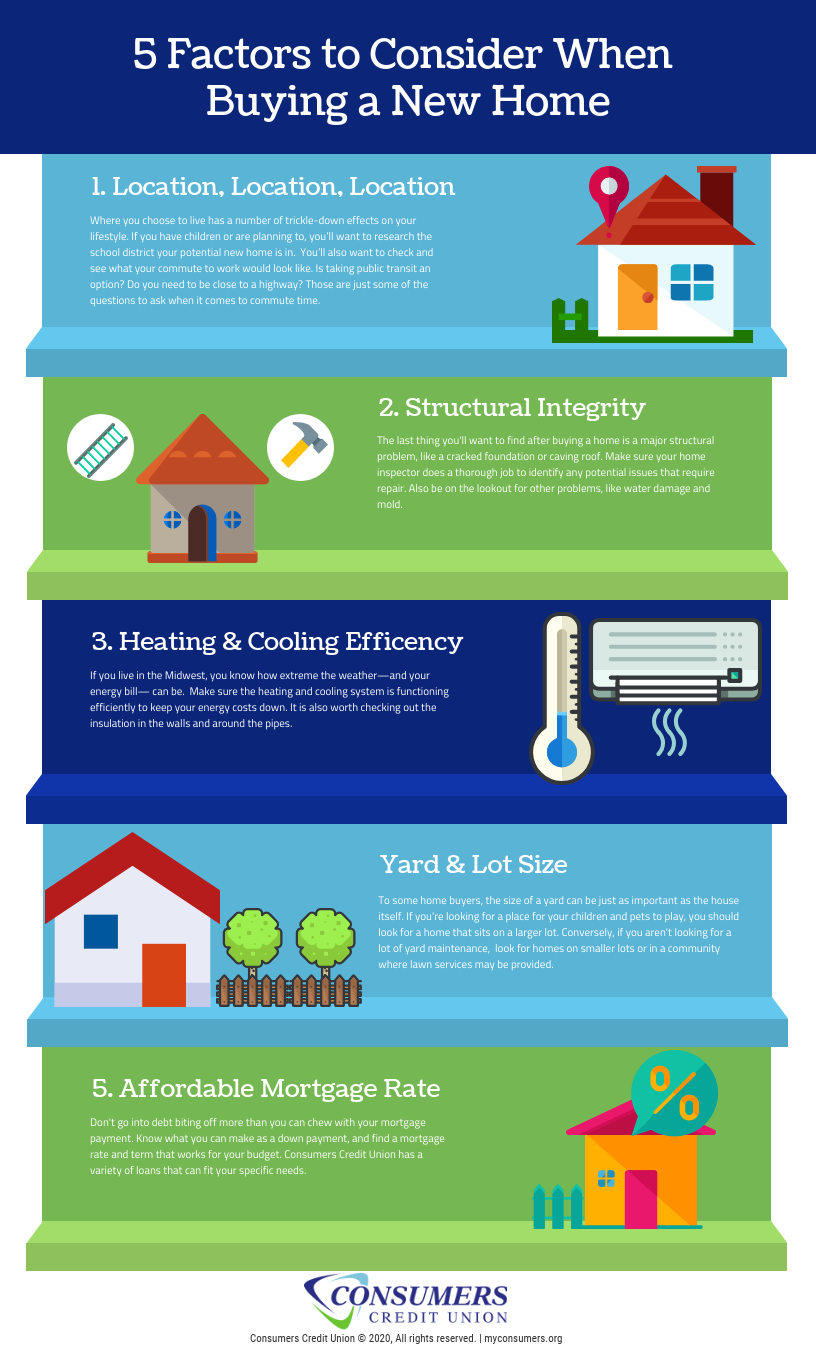

5 Factors to Consider When Buying a Home

The busy real estate season is about to get started. According to the National Association of Realtors, home sales activity between February and March increases 34 percent, and continues into the spring and summer.

There are many factors that go into buying a house, but in this blog, we'll go over the five major factors you should take into consideration before you close.

Location

Location, Location, Location - you'll hear it from just about every realtor, but it truly is very important when home shopping.

Where you choose to live has a number of trickle-down effects on your lifestyle. If you have children or are planning to, you'll want to research the school district your potential new home is in.

You'll also want to check and see what your commute to work would look like. Is taking public transit an option? Do you need to be close to a highway? Those are just some of the questions to ask wen it comes to commute time.

Take note of the noise and traffic when touring the home as well. You may find the level of noise in the area doesn't fit your lifestyle.

Structural Integrity

Before signing any documents, make sure there are not any surprise repairs that may need to take place. The structure of the house is most important.

Be on the lookout for signs of water damage - water stains, discoloration, or bubbling on the walls. This could lead to the discovery of mold, which can be harmful to your healt.

You'll also want to check the roof, foundation, and plumbing with a home inspector. While you may not like every room color in the house, these are the structural items that you'll want to ensure are in good shape.

Heating/Cooling/Insulation

If you live in the Midwest, you know how extreme the weather - and your energy bill - can be. It may not be top of mind when shopping, but having an up-to-date HVAC system and proper insulation in your new home could reduce heating and cooling costs.

Heating and cooling systems are expensive to replace, but inefficient systems will cost you every month, and will likely have to be replaced over the course of an average 30-year mortgage anyway. You may even want to look into how energy-efficient the windows are as well.

Yard/Lot Size

In addition to finding the right sized home, you'll want to find the right sized yard for your and your family. If you have pets or want to add an addition to the home in the future, you'll want to make sure that you ave the room to grow with your lot size. Conversely, if you are not interested in a lot of yard maintenance, you may look for a home on a smaller lot.

Mortgage Rates and what you can afford

Perhaps most important is shopping for a home you can afford. Know what kind of down payment you can make when buying a house, and how that affects what kind of mortgage you can take on.

Consumers Credit Union has an assortment of mortgage options with competitive interest rates over a variety of terms. We will make sure you can afford the home of your dreams.

;

;