How to Increase Your Credit Score

Your credit score can affect every financial decision you make in the future. If you have a plan to apply for a new mortgage, buy a new car, or qualify for loans or credit cards, having a bad or poor credit score will affect your ability to secure these things.

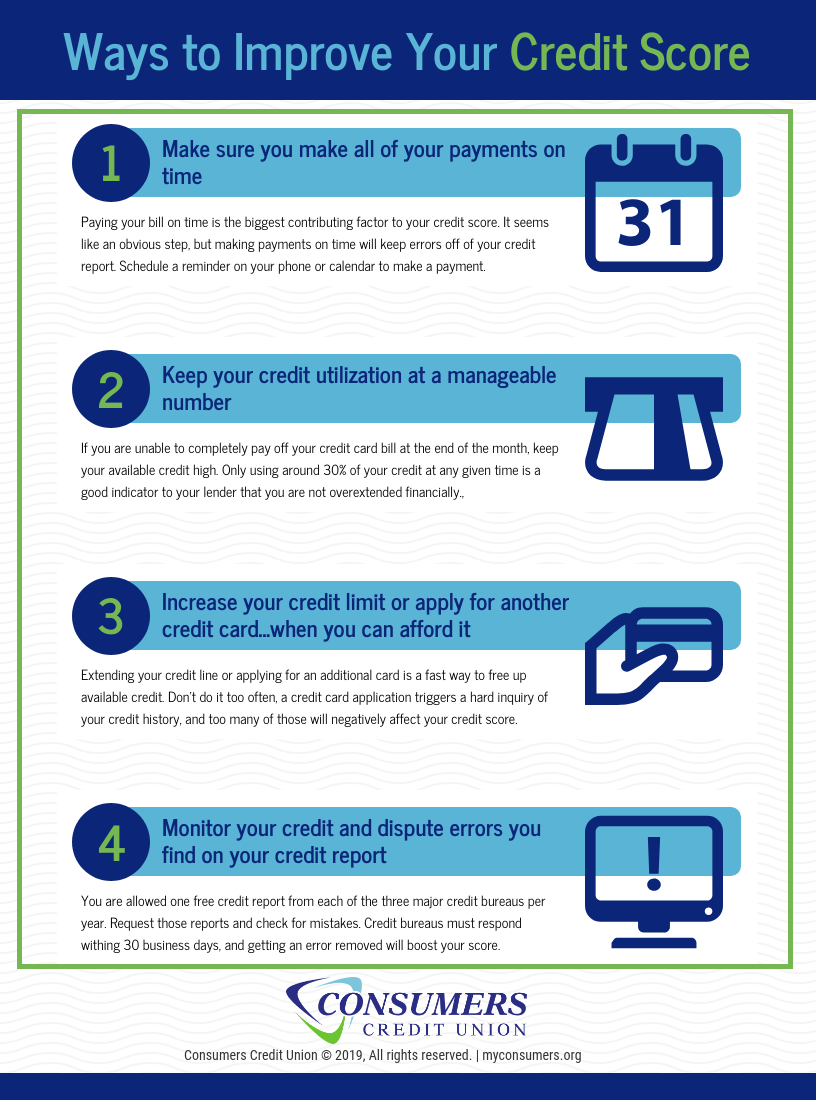

However, there are simple things you can do to starting today that will help grow your credit score. In this blog, we'll go over some of the proactive steps you can take to start building up better credit.

What is a "Good" Credit Score?

Before we delve into tips to increase your credit rating, we should first establish what a credit score is, and what constitutes a good credit score. Your credit score is a number that lets a lender know the risk of loaning you money. The common credit score used by lenders is the FICO score, which is a score created by Fair Isaac Corporation that combines various factors from your credit report into a score.

FICO's website has the following range of scores:

- <580: Poor Credit

- 580-669: Fair Credit

- 670-739: Good Credit

- 740-799: Very Good Credit

- 800 +: Exceptional Credit

Increasing your credit score isn't an overnight process, but there are easy things you can do that will help bump your FICO credit score.

Ensure Bills are Paid on Time

This seems like an obvious step to take, but paying your bills on time will have the largest effect on your FICO score. Ater all, a credit score is a rating that is used to notify lenders how reliable you are in paying back loaned money. Therefore, it is no wonder that 35% of a FICO score calculation comes from making payments on time.

Check with your credit card company to see when your balance is pulled for credit checks (usually at the end of the month), and set a reminder for yourself to make your payment. Your creditor may also offer auto-payments, which can be set to ensure you at least make a payment each month. Making that payment each month will ensure you don't have any delinquent payments in your history.

Keep your Credit Utilization at a Manageable Number

The second biggest contributing factor to your credit score is your credit utilization, also known as your credit limit. This makes up 30% of your FICO score.

It is always best to pay off your credit card bill in full, but if you are unable to, aim to have less than 30% of your credit used by the time a payment is due. This will show lenders that you are not overextended.

You can keep your monthly payments lower by making micropayments, which are multiples of smaller payments that are easier to manage. You could even go as far as making a payment immediately after a transaction goes through. This way, you will always ensure you are able to pay your credit bill in full.

Increase Your Credit Limit or Apply for Another Credit Card As Needed

It may seem counter-intuitive, but in some situations, increasing your credit or applying for another credit card may help improve your credit score. This is because it will immediately decrease your credit utilization. Be careful with this option though, because it will trigger a hard inquiry on your credit score, and too many inquiries will actually hurt your credit. It will also decrease your average credit age.

Despite some of the cons, if you are financially stable enough to afford multiple cards and don't overspend, having a better credit mix can increase your score.

Apply for a Consumers Credit Union Visa Card

Consumers Credit Union has a number of Visa Credit Cards with a variety of different rewards available for purchases on things like travel or groceries with no annual fees.

Check out our competitive credit card rates and apply for a credit card from Consumers Credit Union today.

;

;