Benefits of Providing Your Child a Debit Card

As your children grow older, you'll notice that they may ask to be dropped off to hang out with their friends at the mall, or go with a group to see a movie. Of course, all of these things cost money, and having to keep track of and carry cash around can be a hassle for them, just as it is for you. So when is it appropriate for your child to have a debit card? We'll go over when you should have that conversation, and some of the benefits and protections it affords.

What age is appropriate for debit card ownership?

There is no one size fits all answer to this question, as every child is different in terms of maturity and responsibility. However, you may be hard pressed to even find a financial institution that allows minors and teenagers to have debit cards under their own name.

At Consumers Credit Union, we offer Student Choice Checking to Members aged 13 to 17 that allows them to get their first taste of banking.

Teaching Financial Responsibility at an Early Age

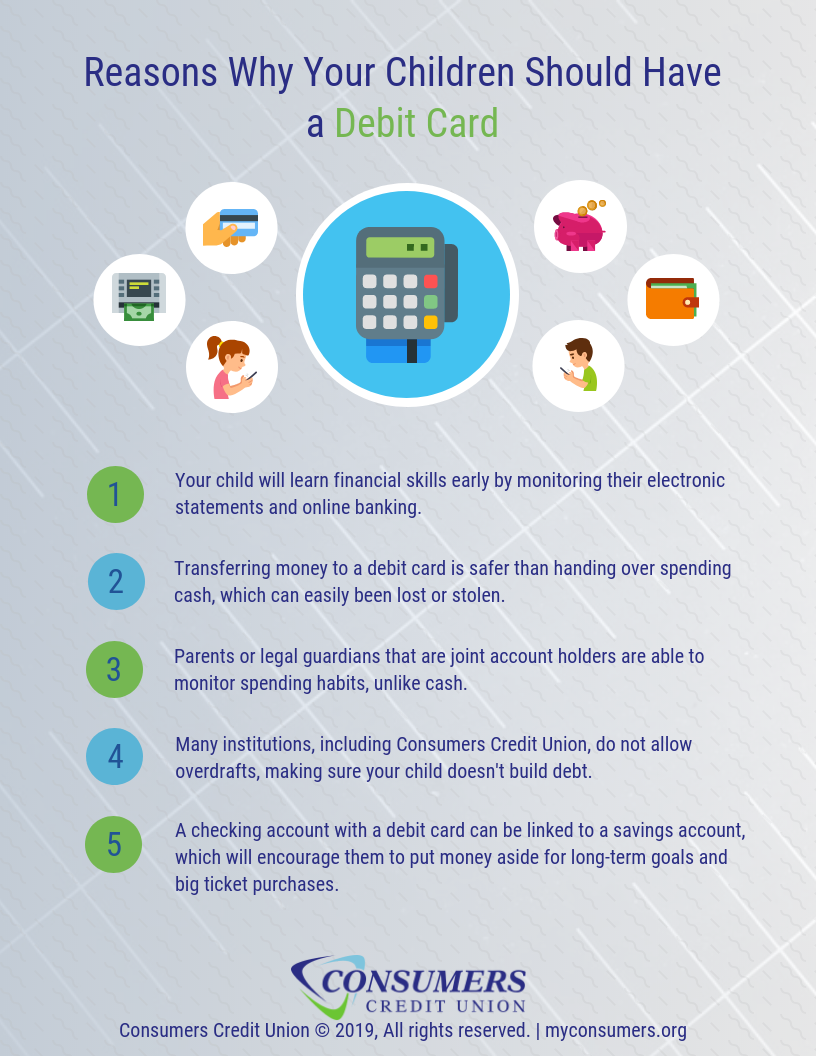

Giving your teen their own checking account with a debit card will go a long way for teaching them financial literacy. Rather than paying them cash for chores, transfer money into your joint account that they can manage.

Your child will get their own electronic statements and will have access to online banking, so they can learn how to keep track of their account balance and plan a budget.

Debit Cards are Safer than Cash and Can be Monitored

Cash can be hard to keep track of and can easily be lost, even for adults. And once cash is lost, it's gone. If your child loses their debit card, you can easily freeze the card until it is found or replaced.

As a join account owner, you'll also have access to account statements. If you notice a pattern in your child's spending habits you want to correct, you can put limits on the amount of money in their account, and have productive conversations with them about saving money.

Consumers Credit Union Has Banking Options for Your Child

Consumers Credit Union is happy to offer Student Choice Checking accounts that include a debit card with daily limits, AMT fee reimbursement, and the same mobile and online banking features as regular bank accounts.

We also offer Student Visa Credit Cards for those who are looking to get an early start on their credit score.

Whatever you may be looking for, Consumers Credit Union will help guide your children toward financial responsibility.

;

;