Digital Banking

Digital Banking Upgrade Complete!

You can now enjoy an improved, fully featured experience. See below for first-time login instructions.

We've listened, and transformed your digital experience. From a new website and digital banking, to fully-integrated cards management and easier account opening, it's another reason we're known as The People In Your Corner.

Check your Information

- Make sure your email, address and phone are correct

We're Upgrading for You

- Improvements to your digital banking experience based on your feedback

- Personalized for you

Always Secure

- Additional alert and security options

- Authenticator app option

Easy to Use with More Features

- New, mobile-first design

- Improved navigation

- Enhanced search (transactions, features, FAQ)

- New Statements & Documents hub

- New Transfers hub

- Card information and management all in one place

- Enhanced Bill Pay experience with Find My Bills Feature

- More digital banking support at your fingertips

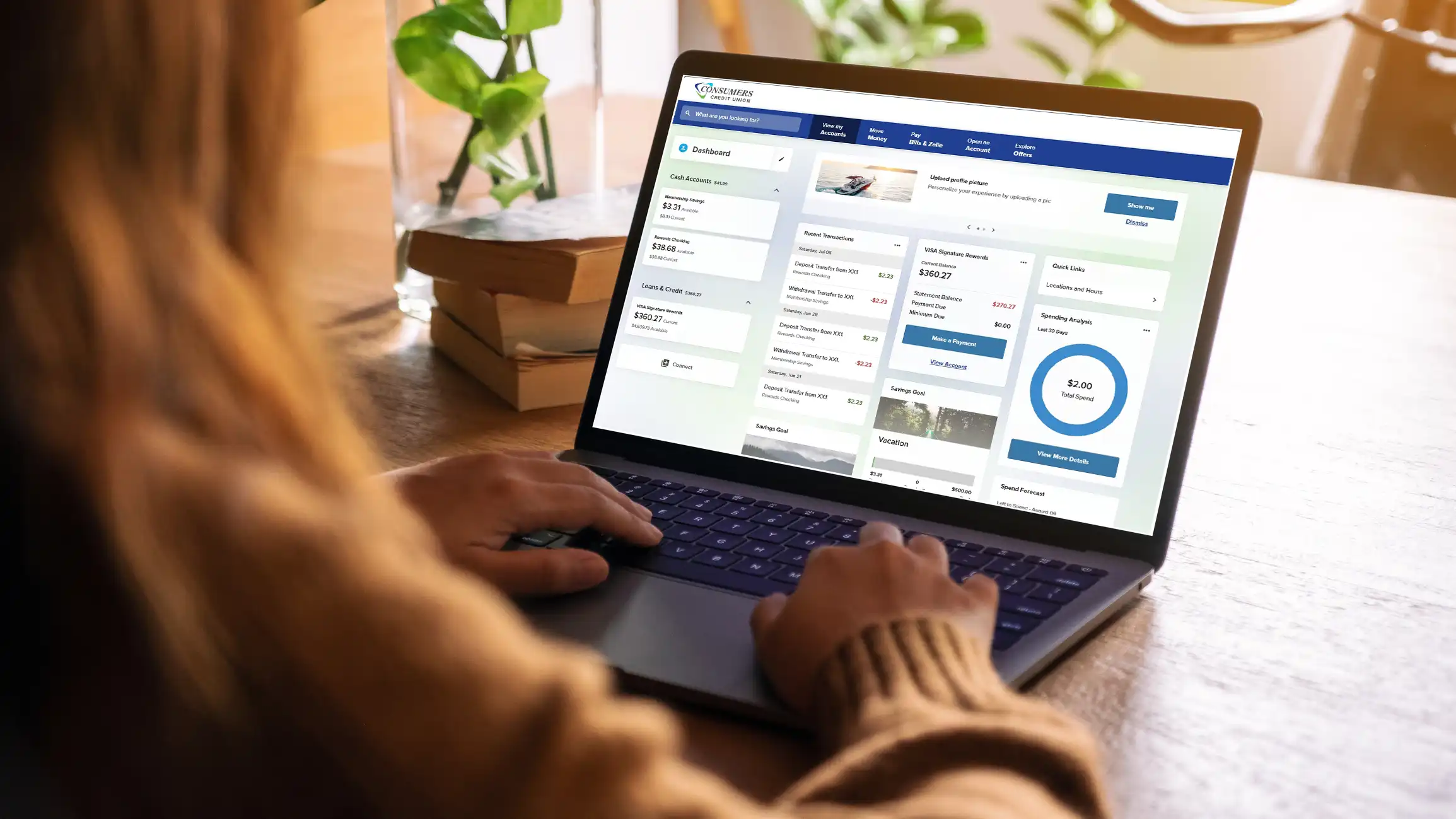

Your New Experience

- View all accounts with a single login

- See account balances across all accounts, even external accounts

- Organize your accounts (reorder, show, hide)

- Customize which types of recent transactions you would like to see

- Access new tools such as savings goals, spending analysis and more

- View personalized offers and ways to make the most of your membership

Let's get you started!

- Login for the first time

The first time you log in, you’ll use your CCU digital banking Username and your current password, then fill in the requested information. If you haven't accessed digital banking recently, you may need to register as a new user.

- Check your mobile app

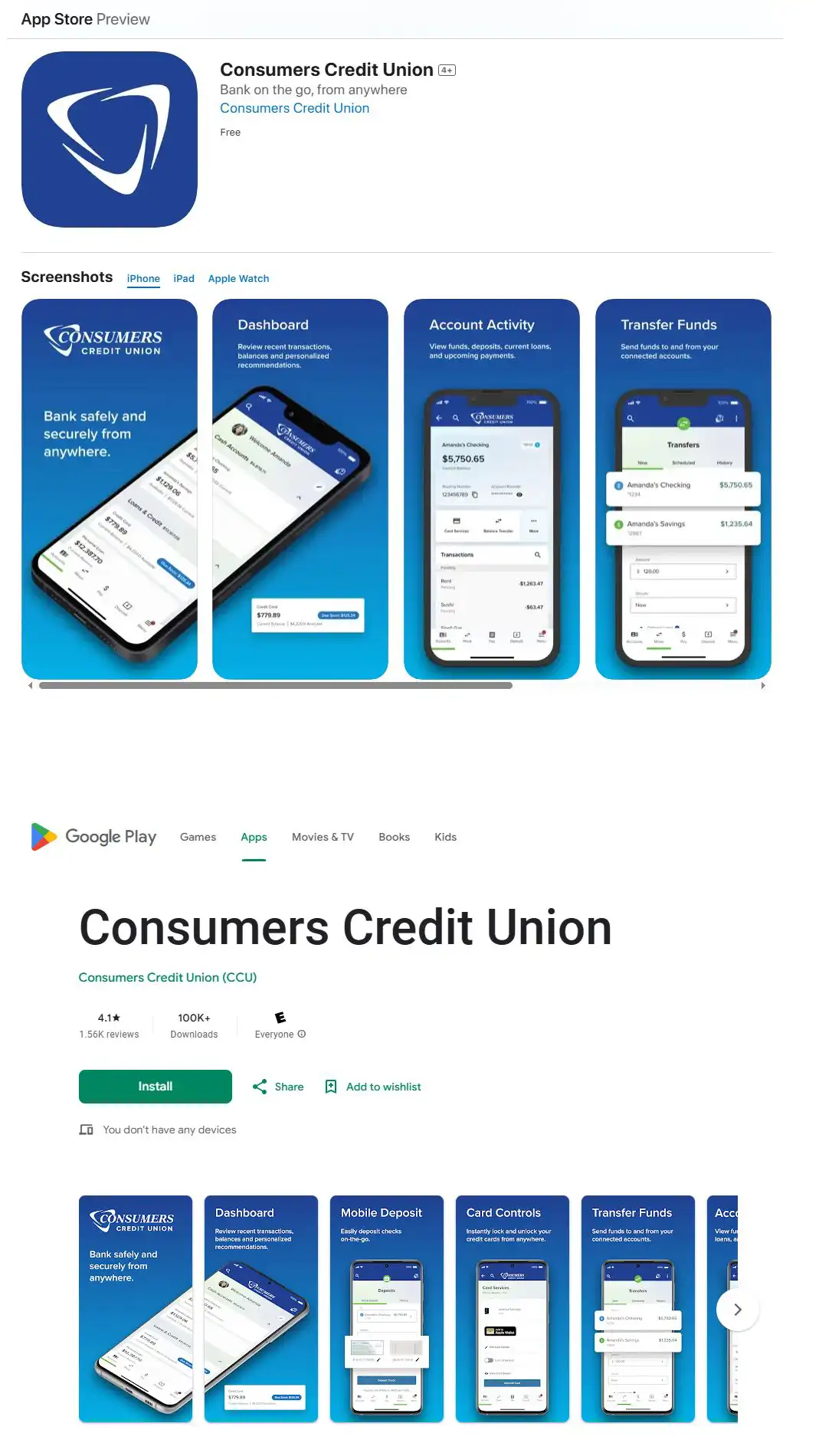

If you don’t have automatic app updates on, you’ll need to update the CCU Mobile App in your app store. The new app has a blue background instead of a white one.

- Update your digital banking bookmark

Here is the new link: https://digital.myconsumers.org/login

- IMPORTANT: If you have a CCU Visa Card, complete these important steps

Review and re-establish any future CCU Credit Card payments that did not carry over after August 18.

- Log in to Digital Banking > Move Money > Scheduled Transfers

Re-register your card. This will allow you to set up Alerts & Controls.- Log in to Digital Banking > Select Card on Dashboard > Card Services > Advanced Card Controls > Register

- Set up Alerts and Controls

Log in to Digital Banking > Select Alerts from the navigation menu, then set up alerts for accounts, cards, security and more.

Digital Banking Upgrade FAQs

As we strive to be the people in your corner, we are here to help with answers to your frequently asked questions.

Learn More About Digital Banking

How do I update contact information?

Simply log in to digital banking, select Profile & Settings, then select Contact Information. You will be able to update your phone numbers, email, and address.

When did the digital banking upgrade happen?

The upgrade happened on Tuesday, August 19, 2025.

Why did CCU make this change?

Your digital banking experience has been upgraded based on member feedback. The new platform offers a mobile-first design, enhanced navigation, and a customizable dashboard—making it easier to manage your accounts. You’ll also benefit from improved search, added security options, and new tools like savings goals, spending analysis, and personalized offers.

These enhancements make digital banking more personalized, secure, and user-friendly than ever.

Did my existing account information transfer over?

Your account information has been transferred over. We strongly recommend that you review closely. If you notice any discrepancies, please contact us immediately at 877.275.2228

How do I sign into the upgraded digital banking experience? Did my login information change?

Login from the myconsumers.org home page or from our new mobile app. You will use the same Login ID and password. For your security, you will need to complete an additional multi-factor verification for your first login. If you would like to change your login credentials, you may do so afterward.

Do I have to download a new CCU mobile app?

If you already have the CCU mobile app and your device is set to receive automatic app updates, the app will update once it is available. The app icon will be blue, so it will be easy to tell if it has been updated. If the app does not update automatically, you can download it from the Google Play Store or the Apple App Store.

Why am I not receiving push notifications?

If you have not received push notifications, it may be because you do not have notifications enabled for the CCU mobile app. This can be controlled in your device’s settings.

Did my existing alerts and controls carry over?

Since this upgrade includes more options for alerts and controls, you will need to take a few minutes to re-enter your preferences.

Do I need to update existing transfers, bill payments or automatic payments?

Existing transfers and payments will carry over with a few exceptions. If you are affected by an exception, you should have received a separate email communication from CCU. We recommend that you review your account and payment details carefully when you log in for the first time to ensure everything appears as expected.

Will I need to update my CCU credit card payments?

Please review any previously established future or recurring credit card payments set up for your CCU credit card.

Payments scheduled after August 18 did not carry over.

If that’s the case, you’ll need to re-enter your payment details to ensure they continue as expected.

If that’s the case, you’ll need to re-enter your payment details to ensure they continue as expected.

- Log in to CCU Digital Banking

- Click on your credit card account

- Select Make a Payment

- Follow the prompts to set up your future or recurring payments

Can I edit my CCU dashboard?

Yes, you can edit your dashboard to re-order, show, or hide accounts or as well as widgets on the page.

Will I need to update my CCU account nicknames?

Most account nicknames carried over. To add a new nickname, select your account and then choose 'Account Details'. Please note that each account can have only one nickname. For joint accounts, the nickname will be shared

Will I need to reconnect to Quicken?

Yes. If you are a Quicken or QuickBooks user, you will need to take certain steps to allow for a smooth transition.

The first action date is by Sunday, August 17, to complete the final transaction download.

The second action date is August 19, when you must deactivate/reactivate so that your Quicken/QuickBooks accounts are set up with the new connection.

Please follow the detailed instructions below to prepare for the upgrade:

How do I enroll in digital banking? I haven't used it before

If you haven't used CCU's digital banking previously, click here to get started: https://digital.myconsumers.org/registration