Open a CCU checking account and enjoy access to some of the nation's best benefits.

Up to 5.00% APY* Earnings

30,000+ Fee-free ATMs^

Secure Digital Banking

Early Payday

Fraud Protection and NCUA Insurance

Free Nationwide Checking**

And we have some of the best rates in the country.

Rewards Checking

on balances up to $10,000 and make at least 12 debit card purchases each month

- Receive eDocuments (enroll and accept the disclosure)

- Make at least 12 debit card purchases each month.

- Direct deposits, Mobile Check Deposits or ACH Credits totaling $500 or more monthly

Rewards Checking + CCU Visa

Spend $500 or more with any CCU Visa Credit Card each month

- Meet requirements to earn 3.00% APY plus

- Spend $500 or more with any CCU Visa Credit Card each month; no minimum number of purchases

- Earn on balances up to $10,000

Rewards Checking + CCU Visa

Spend $1000 or more with any CCU Visa Credit Card each month

- Meet requirements to earn 3.00% APY plus

- Spend $1000 or more with any CCU Visa Credit Card each month; no minimum number of transactions

- Earn on balances up to $10,000

It's never been easier to earn more.

Eligibility Requirements

Everyone is eligible to join and bank with Consumers Credit Union, regardless of location or financial background. Apply for an account online in minutes without impacting your credit score.

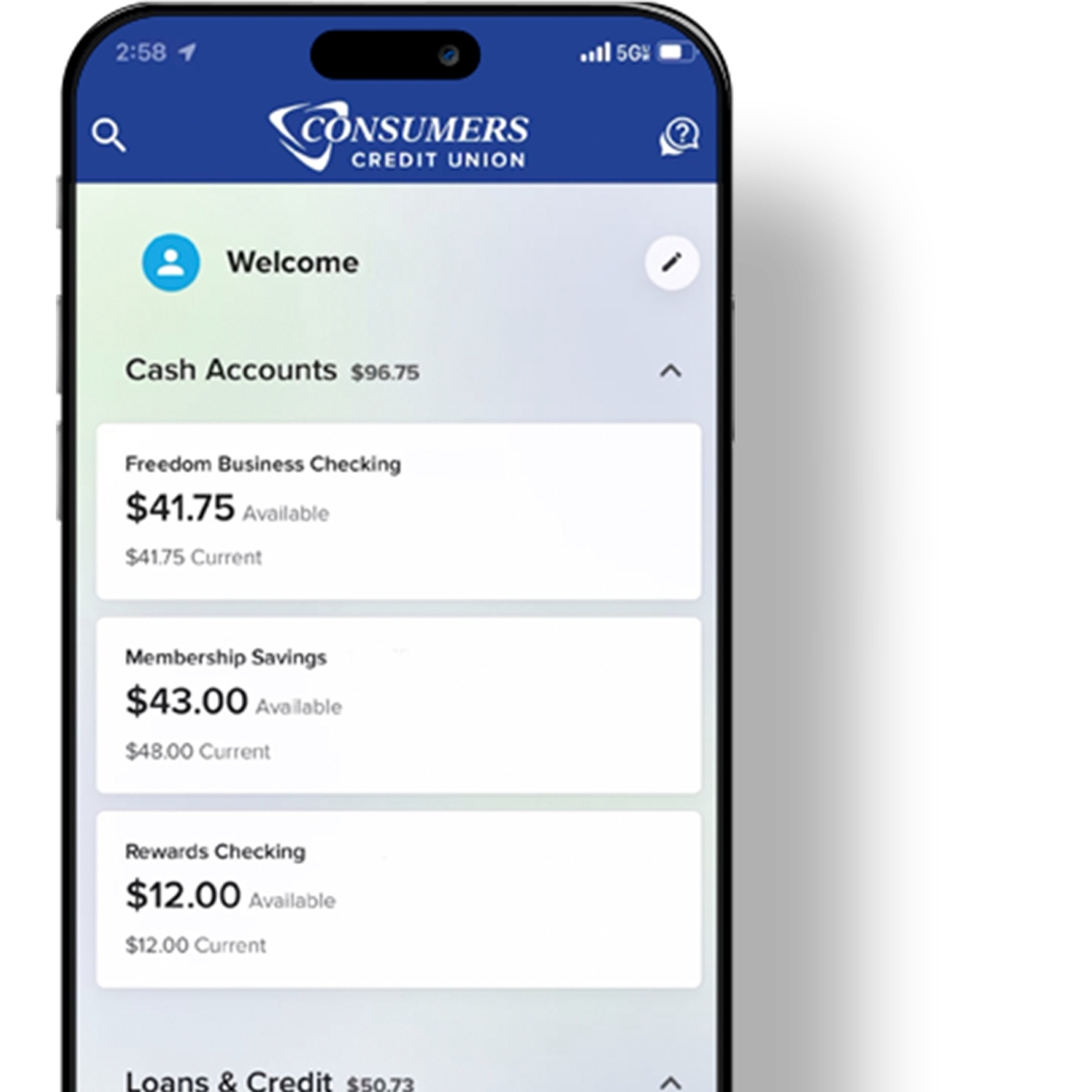

Fast, Secure Digital Banking

Manage your account anytime, anywhere. With advanced encryption and fraud protection resources, you can bank with confidence. No minimum balance required.

Deposit and Withdrawal Options

We offer flexible deposit and withdrawal options, including direct deposit, mobile check deposit, ATMs, and in-branch services. Whether you're adding funds or withdrawing cash, we make it quick, convenient, and fee-free.

Rewards Checking FAQs

Who can take advantage of free Rewards Checking?

Anyone can join Consumers Credit Union (CCU) and apply for a free Rewards Checking account. You can join CCU at the same time you open your Rewards Checking Account online - in minutes!

Do I have to open an account at a branch location?

What happens if I don't meet the monthly activity requirement?

Is my money safe?

Yes! We want to reassure you that your money is safe. We are federally insured by the National Credit Union Administration (NCUA), which is similar to the FDIC for banks. Click here for more information www.NCUA.gov.

Student Choice Checking

Empower your child on the path toward financial independence with a teen checking account.

Smart Saver

Deposit a minimum of $50 or up to $1,000 each month to earn a higher dividend when paired with a CCU Checking Account.

Consumers Have Lost Millions to Rental Scams

People 18-29 were three times more likely to report losing money to a rental scam than other adults.

Your 2026 Credit Score Playbook

Learn how credit score calculations are changing and what you can do about it.

The Anti-Resolution Guide to Growing Your Savings

If your New Year's resolutions include “better budgeting,” you’re not alone. Here are several tips to help you save money and accomplish that goal.

*APY = Annual Percentage Yield. CCU’s free Rewards Checking account is a tiered rate account based on qualifying activity. For balances from $ .01 - $10,000, the rate is based on qualifying activity and can range from 3.00% - 5.00% APY if minimum qualifications are met. For all tiers, if minimum qualifications are met, balances from $10,000.01 - $25,000.00 earn 0.20% APY and balances $25,000.01 and greater earn 0.10% APY. Please see all terms and conditions on qualifying rate tiers. Fees may reduce earnings. No minimum balance required.

**Minimum $5.00 opening deposit required.

+Early Direct Deposit fund access depends upon your employer sending us a notification of the paycheck ahead of the scheduled deposit date. For this reason we cannot guarantee early deposits in all cases.

^CCU will refund fees charged by other bank ATMs when you meet your minimum Rewards Checking requirements.