Find the right savings account for you.

Setting up your first savings account

- Gain membership to Consumers Credit Union

- Low minimum balance – just $5 to maintain membership

- Competitive dividend rates

- Online banking options

Planning for retirement

- Available for Traditional, Roth, and Educational IRA funds

- Earn higher yields

- Possible tax deductions available

Plan ahead for a big spend

- Save with a long-term plan for your kid's education

- Save for short-term holiday expenses

- Save effortlessly with direct deposit or automatic transfers

Membership Savings Account

Become a member of the Consumers Credit Union family.

- Low minimum balance – just $5 to maintain membership

- Competitive dividend rates

- Online banking options

Holiday Club Savings Account

Plan ahead so spending doesn't ruin your new year.

- Minimum $5 to open account each year

- Arrange direct deposit or automatic transfers

- Funds transfer to Membership Share Savings Account on November 1*

- Automatically renews each year

*If funds are withdrawn by request prior to November 1, the account will be closed.

Money Market Account

Earn a high-yield with the flexibility and security you need.

- Enjoy a high yield

- Tiered Money Market account keeps money accessible

- Dividends are compounded and credited monthly

Tax-Advantaged Accounts

Coverdell Education Savings Account

Save for your kids' education. Available as money market accounts, certificates, or an IRA Savings account.

IRA Savings

Create a solid plan for retirement. Available for Traditional, Roth, and Educational IRAs.

IRA Money Market Account

Earn higher yields while keeping funds accessible. Available for Traditional, Roth, and Educational IRA funds.

CCU Savings Account FAQs

Is my money safe?

Yes! We want to reassure you that your money is safe. We are federally insured by the National Credit Union Administration (NCUA), which is similar to the FDIC for banks. Click here for more information www.NCUA.gov.

How can I qualify for an HSA?

- You must be 18 years or older.

- You must be a Consumers Credit Union member with a minimum $5 balance in your personal savings account.

- You must be enrolled in a high-deductible health plan (HDHP) and not covered by another general coverage medical plan or Medicare.

- Individual coverage

- Minimum annual deductible of $1,700

- Annual out-of-pocket expenses (deductibles, co-payments, but not premiums) cannot exceed $8,500

- Family coverage

- Minimum annual deductible of $3,400

- Annual out-of-pocket expenses (deductibles, co-payments, but not premiums) cannot exceed $17,000

- These limits are in accordance with the IRS guidelines for minimum deductible and maximum out-of-pocket expenses.

Health Savings Account (HSA)

This account provides competitive monthly dividends along with no account fees. To contribute you must be enrolled in an eligible High-Deductible Health Plan.

Smart Saver

Deposit a minimum of $50 or up to $1,000 each month to earn a higher dividend when paired with a CCU Checking Account.

Sun’s Out, Funds Out: 10 Tips for Summer Spending

Summary: Summer fun time is here! But gas, eating out, and entertainment can easily strain your budget if you’re not prepared.

7 Tips to Model Healthy Money Management

As adults, how we handle finances sends a powerful message to children. Here are seven ideas to help shape kids' attitudes about finances.

What is the True Cost of Convenience?

Many people enjoy the ease and convenience of home grocery delivery and meal delivery services. But what's the full cost?

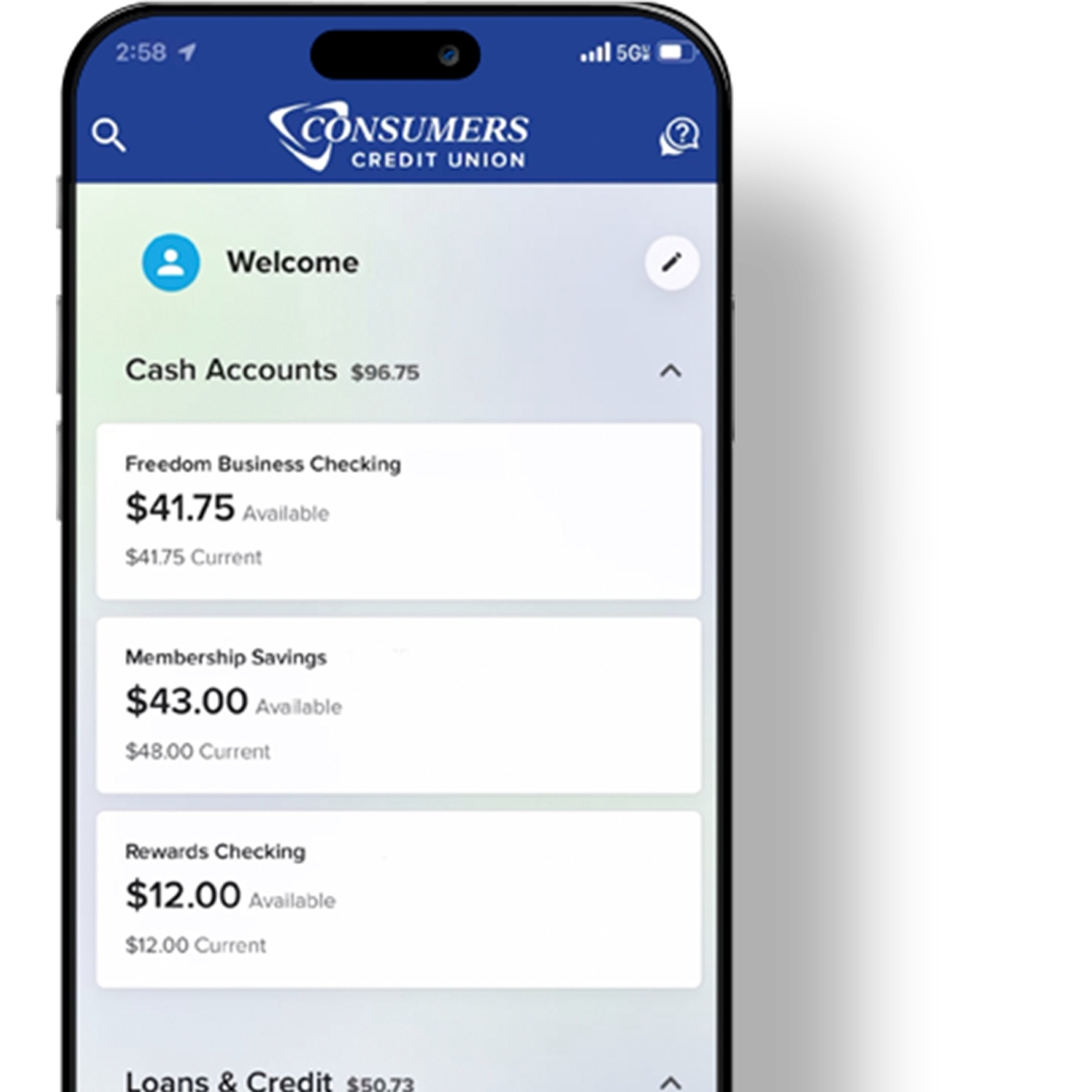

Bank anytime, anywhere.

Download the CCU mobile app for fast, secure access to your accounts, easy transfers, mobile check deposits and more.