The Anti-Resolution Guide to Growing Your Savings

January 27 2026

Small Systems Win

If you’re reading this, there’s a good chance you tried the “a new year, a new savings goal” thing before – and life, inflation or a surprise bill had other plans. You’re in good company. According to NerdWallet’s 2026 Consumer Outlook Report, more than half of Americans expect prices to keep climbing this year.

When costs feel unpredictable, saving can start to feel less like a goal and more like a gamble – especially if you’ve been burned before.

Building savings doesn’t have to rely on willpower, perfect timing or one big, make-or-break resolution. Instead, the most resilient savers focus on small, repeatable systems that work with real life – not against it. Systems that keep moving forward even when prices zigzag or plans change.

Below is a step-by-step playbook to help you do exactly that.

1. Start Micro: A $5 – $15 “Savings Drip”

Why it works: Psychologically, micro-transfers keep momentum without triggering scarcity – especially when groceries, utilities and insurance premiums are doing their own thing.

How to do it today

- Auto-transfer $5 – $15 every payday to a savings account you don’t touch.

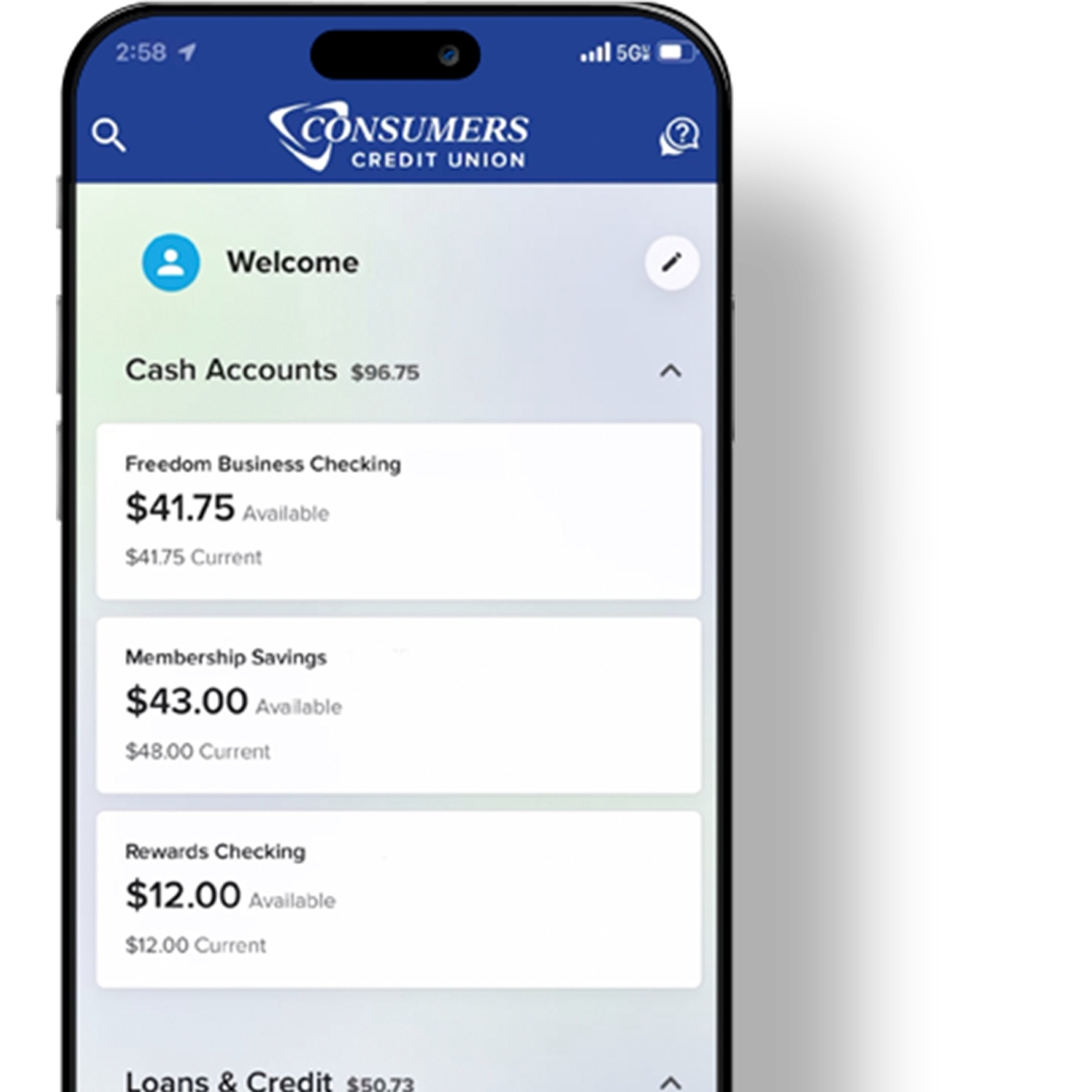

- Label it “Safety Net” in your banking app. Visual cues help.

- When budgets feel tight, lower the drip – don’t stop it.

Pro Tip

Put the drip in a high-yield savings account (HYSA) or similar checking account so your dollars earn more while you sleep. Accounts like these still pay several times the national average – despite recent Fed rate cuts – so it’s low effort, real gain.

2. Park Cash Where It Grows (Not Where It’s Convenient)

If your savings are sitting where they’ve always been, that’s understandable. Most of us opened an account once and moved on – because life got busy. But over time, “set it and forget it” can quietly cost you.

Making your savings work harder doesn’t require taking risks or changing habits. It usually just means checking whether your money is parked in a place that still serves you.

Your quick action

- Take a few minutes to look at savings account options. Moving an emergency fund can feel like a hassle – but it’s often a one-time switch that pays you back every month.

- If part of your savings won’t be needed for 6–12 months, consider a laddered CD for that portion to lock in a rate – while keeping at least one month of expenses fully liquid for peace of mind.

3. Budget for the Reality You Feel

Think your budget is fine, but your wallet disagrees? You’re not imagining it. Everyday costs add up faster than most budgets anticipate. In 2025, the average monthly grocery spend in the U.S. is roughly $665 per person (and in many states it’s even higher).

A realistic budget isn’t about discipline or deprivation. It’s about updating your plan so it actually works for your life today.

Try this 20-minute refresh

- List the “movers.” Identify the categories that quietly crept up this year and now take more of your paycheck.

- Right-size with compassion. Increase caps where costs are unavoidable – and trim areas you’re no longer using or valuing, like forgotten subscriptions or unused memberships.

- Pre-fund the surprises. Set aside a little each month for irregular but predictable costs (like car repairs or copays). When they hit, they’ll feel less like emergencies.

- Be selective with rewards. Cash back and points help if balances are paid in full.

A budget that acknowledges reality – rather than fighting it – gives you more control and a lot less stress.

4. Triage High-Cost Debt First

Credit card delinquencies and balances climbed from pandemic lows and remain elevated, signaling stress for many households. If minimums feel like quicksand, tackling interest is the fastest way to free cash for savings.

Your options

- Snowball/Avalanche: Pay smallest balance or highest APR first – whichever keeps you consistent.

- Ask for an APR reduction: A five-minute call can lower a rate, especially if you’ve been on time.

- A Debt Management Program can roll multiple cards into one payment and often secure lower interest rates from creditors, cutting stress and helping you rebuild savings sooner.

5. Automate the “Boring” Wins

You don’t need to overhaul your life to make progress. Setting up simple systems that quietly build savings can be more effective than occasional big leaps.

- Bill calendar + autopay for essentials in order to avoid late fees and protect your credit profile.

- Roundups: Enable roundup transfers (or a weekly $10 sweep) to your HYSA.

- Quarterly check-in: Every three months, raise your savings drip by $5 – small enough to feel easy, meaningful over a year.

6. Don’t Wait for Certainty

The perfect moment rarely comes – so start anyway. Life is unpredictable. Instead of waiting for ideal circumstances, plan around them and build security over time.

- Keep 3–6 months of essential expenses as the target over time (not overnight).

- Split savings: 80% emergency fund / 20% “future you” (home maintenance, car, medical).

- If your income is variable, build a one-month “buffer” first (rent/mortgage + groceries + utilities), then expand.

Simple Swaps That Save

- Swap brands and stores, not meals: Same recipes, different labels (or warehouse club for staples) can shave 10–15% off grocery bills.

- Utility “nudges”: Smart thermostat schedules and LED swaps lower monthly costs with one-and-done changes.

- Insurance shopping: Quote home/auto annually; bundling or usage-based programs often save 5–10%.

- Library and other local perks: Free streaming, museum passes, and workshops can replace paid services.

With GreenPath, There’s a Plan for Every Dollar

GreenPath’s NFCC-certified financial counselors are here to listen, guide and help you find clarity – completely free and confidential. Together, you’ll explore your options, create a plan that fits your life, and take realistic steps toward easing financial stress.

And if there’s never enough to cover what matters most, our Debt Management Program (DMP) can help. It turns today’s pressure into room to save, plan and regain control of your finances.

This article is shared by our partners at GreenPath Financial Wellness, a trusted national non-profit.