Expert Insights and Everyday Tips for Financial Wellness

Declare Your Financial Independence

With Independence Day done, it's back to regular, sweaty summer days. But if the heat you feel isn't from the sun, maybe you need a new financial plan

What to be Aware of When Buying Investment Property

Thinking about buying investment property? There are a lot of factors to consider if you're going to do so.

Hurry Up and Give Them Your Money!

Don't be fooled by high-pressure tactics of scammers who call you to try to get money from you.

Stopping Spam Texts and Emails

Spam consists of unsolicited messages sent in bulk by email and text. Learn how to stop the inflow.

Money Management Tips Every Small Business Owner Should Know

Whether you’re about to start a business or you’ve been established for decades, we’ve got some money management tips for you.

Be Aware of Contractor Fraud and Scams

Fake or unlicensed contractors may try to take advantage of residents affected by severe weather events.

Protecting Your Business from Fraud

Fraud prevention for business accounts is a crucial aspect of maintaining financial security and protecting your business from potential losses.

Have you gotten a call about a prize for a contest you never entered? It might be a scam. Here are some tips to spot this fraud.

Commonly Overlooked Tax Deductions

Here are some tax deductions you might not know about… and they could save you a lot of money.

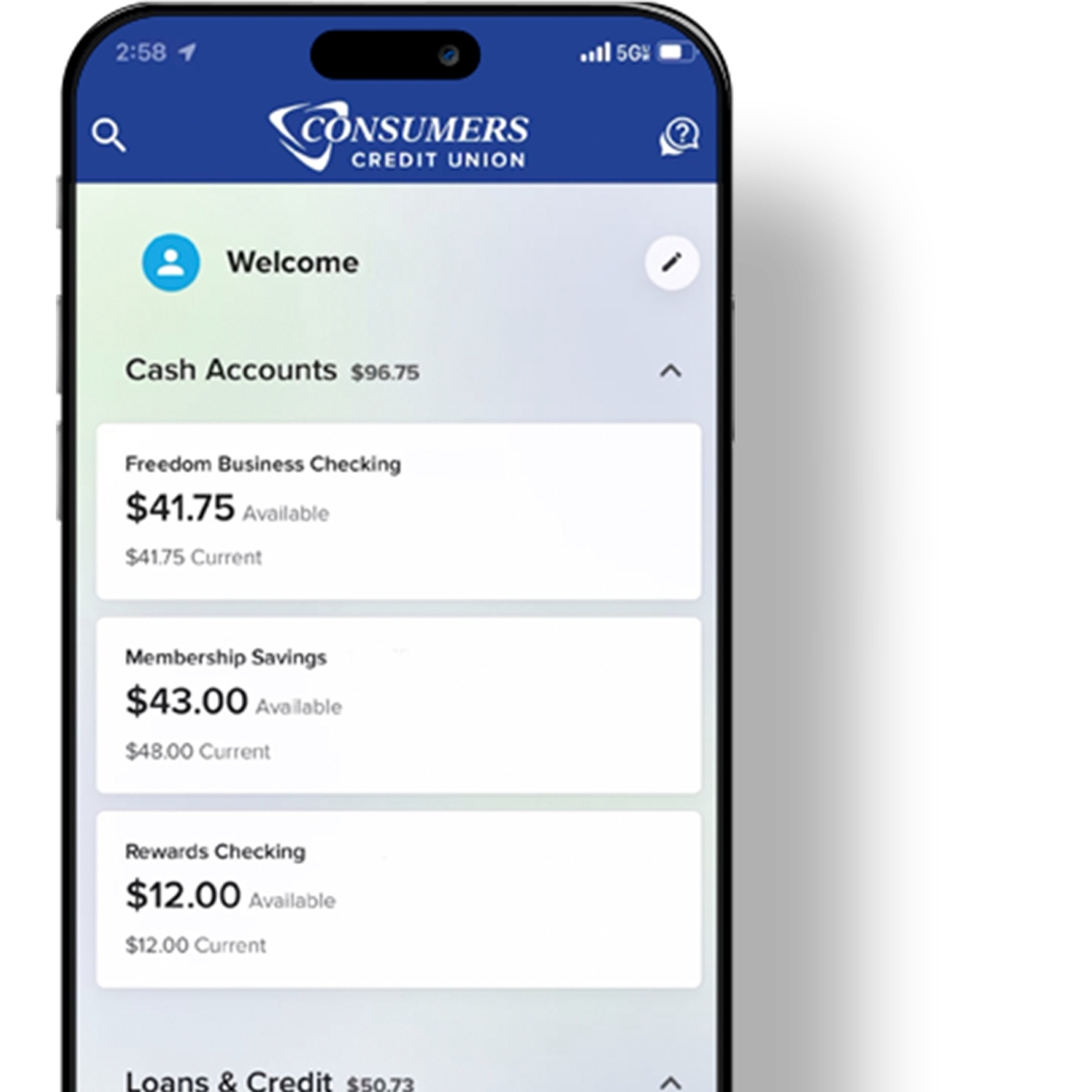

How to Choose the Right Budgeting Tool

Whether you use an app or pen & paper, hopefully you track your finances and have a budget. If not, we have information for you that can help.

Job Scams That Target College Students

If you're a college student on the job hunt (or know one who is), here's some important info about how scammers are on the prowl.

Slow Your Scroll: Spot and Avoid Social Media Giveaway Scams

Scammers will use any avenue they can to get your money and personal information. Watch out for social media giveaway fraud.