Never Too Early: Tackle Credit Card Debt Before Holiday Spending Hits

August 27 2025

A little planning now can save you a lot of financial stress come December.

Small steps – like budgeting and prioritizing high-interest balances – can make a big difference.

Why It’s Smart to Tackle Credit Card Debt Now

The holidays are a time of joy, family, and celebration – but they can also come with a big price tag. And if you’re already carrying credit card debt, the added pressure of seasonal spending can turn that financial burden into a full-blown snowball. In fact, even high-income households are feeling the pinch, with more Americans across income levels falling behind on credit card and auto loan payments.

Before the holiday shopping season kicks off, it’s time to get proactive. Taking a few steps now could mean a lot less stress when the bills arrive in January.

Step 1: Get a Clear Picture of Your Debt

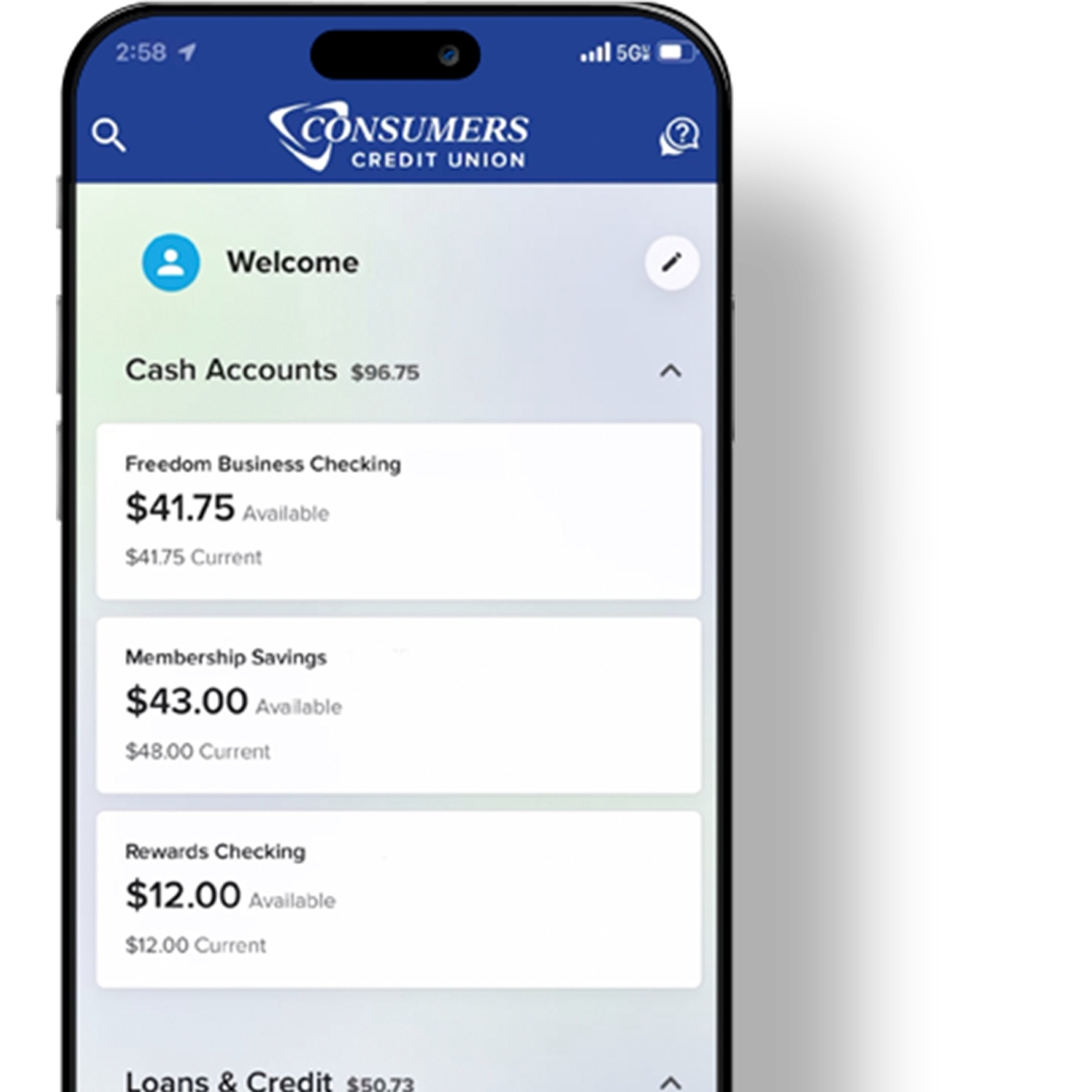

Start by listing all your credit card balances, interest rates, and minimum monthly payments. If you haven’t looked lately, check your latest statements or log in to your accounts. Seeing the full scope of your debt can be overwhelming – but it’s also empowering. It gives you a starting point. Knowing exactly how much debt you have and understanding your total debt is crucial for accurately assessing your financial situation and choosing the best repayment strategy.

Pro Tip

Create a simple spreadsheet or use a free debt tracker app to list your balances, interest rates and due dates in one place. Seeing it all laid out can make the situation feel more manageable and less abstract.

Step 2: Build a Bare-Bones Budget (Just for Now)

You don’t need to commit to a minimalist lifestyle forever. But for the next few months, consider trimming non-essential spending. Think: eating out, streaming subscriptions, impulse buys. Using a debit card instead of a credit card can help you avoid overspending and impulse buys. Funnel those savings toward your credit card balances.

Even an extra $100 a month can chip away at your debt and free up room in your budget for holiday expenses without relying on plastic. Using any extra money, extra funds, or extra income – such as bonuses or side gigs – can help you pay off debt faster and free up more money in your budget.

Pro Tip

Set a calendar alert each week to review your bank and credit card statements. Staying mindful of your spending can help you curb it naturally.

Step 3: Choose Your Payoff Strategy (Including Balance Transfers)

There are two popular methods:

- Snowball Method: Pay off your smallest balance or lowest balance first. This gives you a psychological win and momentum to keep going. Once you pay off a debt, roll the entire balance you were paying on that debt into the next smallest balance.

- Avalanche Method: Avalanche methods focus on paying off debts with the highest interest rates first to minimize total interest paid. This saves you the most money over time.

Both work. The best one is the one you’ll stick to.

Step 4: Pause the Swipe

If you’re actively paying off credit cards, try not to add to the balances. This might mean hitting pause on your credit card use for now. Use cash, debit, or a prepaid card to keep spending in check.

Using a balance transfer card or balance transfer credit card can help you consolidate balances and take advantage of lower introductory rates. Just be aware that there might be transfer fees and balance transfer fees, which can impact your overall savings.

To reduce temptation, it can also help to unsubscribe from promotional emails or delete saved cards from your browser. Using cash or debit can also help you avoid the extra fees that sometimes accompany credit card transactions.

Pro Tip

Try a “no-spend” challenge for a week – limit purchases to bills and essential purchases only. Use that saved money to make an extra credit card payment and build momentum before the holiday spending urge kicks in. It adds a behavioral strategy that feels empowering rather than restrictive – and ties directly into debt payoff.

Step 5: Get Help if You’re Stuck

If your credit card payments are more than you can handle – even with a plan – it might be time to get professional support.

GreenPath’s Debt Management Program could potentially help you pay off your credit cards in 3–5 years with reduced interest rates, waived fees, and one affordable monthly payment.

Holiday spending doesn’t have to come at the cost of your long-term financial health. A little prep work now can make December more joyful – and January less stressful. You deserve that.

This article is shared by our partners at GreenPath Financial Wellness, a trusted national non-profit.