Understanding the FICO Score Ranges

It’s amazing how much your FICO Score can affect so many aspects of your life, especially when it comes to borrowing money. The most widely used broad-based risk score, the FICO Score, is used in 90% of credit decisions and plays a critical role in billions of decisions each year.

For potential lenders, your FICO Score is a very good indicator of how likely you are to pay credit obligations as agreed. Whether you are applying for a car loan, a home mortgage, or a credit card, one of the first things a lender will do is check your FICO Score. This helps lenders make informed lending decisions quickly and fairly.

What is the FICO Score?

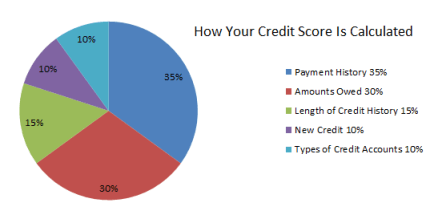

FICO stands for the Fair Isaac Corporation, the company that created the method for calculating credit scores based on information collected by credit reporting agencies. A FICO Score is only a snapshot of your probable credit risk at a certain point in time. FICO Scores take into account various factors in five areas to determine credit worthiness: payment history, amount owed, length of credit history, new credit accounts, and types of credit accounts.

- Payment History 35%

- Amounts Owed 30%

- Length of Credit History 15%

- New Credit 10%

- Types of Credit Accounts 10%

FICO Score Ranges

800 +: Indicates an exceptional FICO Score and is well above the average credit score. Consumers in this range may experience an easy approval process when applying for new credit. Approximately 1% of consumers with a credit score of 800+ are likely to become seriously delinquent in the future.

740 to 799: Indicates a very good FICO Score and is above the average credit score. Consumers in this range may qualify for better interest rates from lenders. Approximately 2% of consumers with a credit score between 740 and 799 are likely to become seriously delinquent in the future.

670 to 739: Indicates a good FICO Score and is in the median credit score range. Consumers in this range are considered an “acceptable” borrower. Approximately 8% of consumers with a credit score between 670 and 739 are likely to become seriously delinquent in the future.

580 to 669: Indicates a fair FICO Score and is below the average credit score. Consumers in this range are considered subprime borrowers and getting credit may be difficult with interest rates that are likely to be much higher. Approximately 28% of consumers with a credit score between 580 and 669 are likely to become seriously delinquent in the future.

579 and lower: Indicates a poor FICO Score and is considered to be poor credit. Consumers may be rejected for credit. Credit card applicants in this range may require a fee or a deposit. Utilities may also require a deposit. A credit score this low could be a result from bankruptcy or other major credit problems. Approximately 61% of consumers with a credit score under 579 are likely to become seriously delinquent in the future.

Knowledge about your credit and the impact it has on your future, is powerful. If you’re interested in being informed about your credit, consulting your FICO Score is a great place to start. A FICO Score is a valuable measure of your creditworthiness, as a lender might see it.

Take advantage of a free credit report review from Consumers Credit Union. Contact us or stop by any of our nine locations for more details. We would be happy to help you review and understand the contents of your credit report.

;

;